avtoelektrik35.ru

Prices

Auto Loan Poor Credit

FIX Your Bad Credit Score! Credit Union Car Loans for Bad Credit! Truliant has GREAT used car loans for bad credit Low interest car loans A bad credit car loan can help drivers with repossession issues rebuild a positive payment history! All you have to do is apply for financing. Our professionals. Credit Acceptance empowers car dealers nationwide to help people finance a car, regardless of bad credit or no credit. If you are shopping for a new or used. If you have poor credit or no credit, you'll find competitive Toyota financing offers at DCH Toyota of Torrance. Come to our Toyota dealer in Torrance, CA. How do bad-credit car loans work? On the surface, a bad credit car loan, also called a subprime car loan, works the same as a standard vehicle loan: the car. Financing a car with bad credit is possible—when you get ready to finance a car, your budget is one of the first things you'll need to consider. Look beyond the. Compare the best bad credit auto loan rates in August ; Capital One, Not specified, 24 to 84 months ; Autopay, Starting at %, 12 to 84 months ; Carvana. Poor credit (scores below ); Fair credit ( - ); Subprime ( - ). In fact, we have special relationships with lenders that provide auto financing. A bad credit or subprime auto loan is designed for car shoppers with poor credit or lower incomes that normally would make purchasing a vehicle more difficult. FIX Your Bad Credit Score! Credit Union Car Loans for Bad Credit! Truliant has GREAT used car loans for bad credit Low interest car loans A bad credit car loan can help drivers with repossession issues rebuild a positive payment history! All you have to do is apply for financing. Our professionals. Credit Acceptance empowers car dealers nationwide to help people finance a car, regardless of bad credit or no credit. If you are shopping for a new or used. If you have poor credit or no credit, you'll find competitive Toyota financing offers at DCH Toyota of Torrance. Come to our Toyota dealer in Torrance, CA. How do bad-credit car loans work? On the surface, a bad credit car loan, also called a subprime car loan, works the same as a standard vehicle loan: the car. Financing a car with bad credit is possible—when you get ready to finance a car, your budget is one of the first things you'll need to consider. Look beyond the. Compare the best bad credit auto loan rates in August ; Capital One, Not specified, 24 to 84 months ; Autopay, Starting at %, 12 to 84 months ; Carvana. Poor credit (scores below ); Fair credit ( - ); Subprime ( - ). In fact, we have special relationships with lenders that provide auto financing. A bad credit or subprime auto loan is designed for car shoppers with poor credit or lower incomes that normally would make purchasing a vehicle more difficult.

If you have bad credit, low credit, no credit or have been turned down in the past due to bankruptcy, we can help you get a car loan through a special finance. What Is a Subprime Auto Loan? Subprime auto loans allow consumers with a fair or poor credit history to obtain financing to purchase a used or new car. They. Get Approved For Financing on A New Or Used Car With Bad Credit Near You In Dallas, GA Finance A Vehicle Through Our Credit Forgiveness Program - Having. Will I be able to buy a car if my credit score is low? If your score is in the “poor” range, getting approved will be a challenge, but it certainly won't be. Car loans for bad credit can help rebuild your credit and get you back on track. A Greater Nevada Credit Union car loan for bad credit can be the first step. The current economic hardship has damaged most people's credit to the point where getting auto loan approval may seem impossible. This is when credit history becomes important if you plan to finance with a loan or lease. Lenders and dealerships will check your credit history and credit. You will work directly with our finance specialist to get approved for an automobile loan. If you feel you have very poor, or even no credit, we may be able to. In simple terms, if you have a low credit score (minimum credit score is typically around FICO score), you transfer the qualifying title to the auto. Our subprime financing program can service people with an under credit score, making us the go-to destination for those looking to get a bad credit car loan. The only way to defeat bad credit is to build good credit, but it's difficult to do if you can't find a lender to approve you for a car loan. At Eastern. Bad credit auto loans are special loans for shoppers whose credit history is poor, there is no minimum credit score requirement; instead, bad credit lenders. Poor credit (scores below ); Fair credit ( - ); Subprime ( - ). In fact, we have special relationships with lenders that provide auto financing. Bad credit is something you can overcome. No matter the situation or the circumstances, our credit approval experts can help you get an auto loan and on the. Poor credit car loans offer financial solutions that are designed specifically to assist those who have less than ideal credit. With the sizable volume of car. Who is Eligible for a Bad Credit Financing Auto Loan? · Applicants with poor credit but have worked at the same job for one or more years. · People who have low. If you have low credit or no credit, you can still count on Balise Kia to help you get an auto loan. Visit us in West Springfield today! With our bad credit auto financing process in Honolulu, Hawaii, you can not only drive off in a quality used Ford or another make of used car, but you can also. Reduce the amount you need to borrow by making a down payment. Most lenders are looking for a minimum of 10% down if you have less-than-great credit, and. Bayer Motor Company Is Your Trusted Source for Bad Credit Auto Loan If you're looking to invest in your next new or used car, there's a good chance that you'.

It Jobs Without Coding

This article explores the top 10 jobs in tech without coding requirements, highlighting their significance, required skills, job prospects, and benefits. If you are interested in a cybersecurity position that does not involve coding, consider becoming a computer network architect. Computer network architects have. Many network people have some minor coding experience as well. If your job is to support an application server it helps if you have some coding knowledge to. Some of the easiest tech jobs that don't require coding include:#avtoelektrik35.ru Experience (UX) Designers: UX designers focus on creating user-friendly experiences. In this comprehensive guide, we will explore the various non-coding jobs in cybersecurity, the skills required for each role, and how to pursue a career in. Software Jobs That Don't Require Coding · Video Game Tester Jobs. One option is working as a tester for video games. · Design Maps and Scenery for Games. Jobs like UI designer, UX designer, and mobile designer can all be done with little to no actual coding (though being familiar with code is definitely a bonus). Non-coding IT job roles are essential in the tech industry, spanning various positions from Project Management and System Analysis to UX Design and. In this article, we will explore the top 10 highest paying non-coding tech jobs and salaries, based on recent data and industry trends. This article explores the top 10 jobs in tech without coding requirements, highlighting their significance, required skills, job prospects, and benefits. If you are interested in a cybersecurity position that does not involve coding, consider becoming a computer network architect. Computer network architects have. Many network people have some minor coding experience as well. If your job is to support an application server it helps if you have some coding knowledge to. Some of the easiest tech jobs that don't require coding include:#avtoelektrik35.ru Experience (UX) Designers: UX designers focus on creating user-friendly experiences. In this comprehensive guide, we will explore the various non-coding jobs in cybersecurity, the skills required for each role, and how to pursue a career in. Software Jobs That Don't Require Coding · Video Game Tester Jobs. One option is working as a tester for video games. · Design Maps and Scenery for Games. Jobs like UI designer, UX designer, and mobile designer can all be done with little to no actual coding (though being familiar with code is definitely a bonus). Non-coding IT job roles are essential in the tech industry, spanning various positions from Project Management and System Analysis to UX Design and. In this article, we will explore the top 10 highest paying non-coding tech jobs and salaries, based on recent data and industry trends.

53, Non Coding Tech Jobs · Echocardiograph Technologist - Portland, OR · Associate Manager, Coding Physician OBGYN and Urology · FT - Building /Code Services. This blog post explores 15 AI jobs that allow you to work in this innovative field without needing to code. This blog post explores 15 AI jobs that allow you to work in this innovative field without needing to code. MBA · Content Writing · Video editing · Consultancy · Free lancing · Government Jobs at a very high level post · Indian Navy · Banking officer. There are a lot of jobs in the tech/IT industry that DO NOT involve any sort of coding or knowledge of 'complex' programming languages. Apply To Non Coding Jobs In Pune On avtoelektrik35.ru, India's No.1 Job Portal. Explore Non Coding Job Openings In Pune Now! Jobs in tech without coding – · Technical writer · Technical project manager · Quality assurance (QA) tester · Technical support specialist. Non-coding IT job roles are essential in the tech industry, spanning various positions from Project Management and System Analysis to UX Design and. 5 In-Demand Tech Company Jobs—No Coding Required · 1. Product marketing manager · 2. Business development associate · 3. Tech recruiter · 4. Sales development. There is no real threat to most coding jobs. Software developers will continue to need skilled programmers for years to come. These no-code roles in data science offer huge salaries, remote working opportunities, and promising career growth. Great news for non-coders! You actually can get hired at a cool tech company even if you don't have any coding skills on your resume. Recommended Courses:Project management is one of the prominent non-coding jobs in the IT sector. As a Software Project Manager, you can play a crucial role in. Non-technical career paths in tech do not require specialised coding skills. However, many of these jobs still require a strong understanding of. Best Tech Skills to Learn Without Coding · 1. Product Manager · 2. IT Project Manager · 3. User Interface (UI) Designer · 4. UX Designer (User Experience Designer). Non Coding Jobs jobs available in Remote on avtoelektrik35.ru Apply to Senior Coder, Senior Coding Specialist, Quality Assurance Analyst and more! non coding jobs jobs in remote · Senior Technical Project Manager with Coding, MS Azure, and SQL Experience · Coding Specialist, Gastroenterology, Full-Time. Computer Science jobs without coding 1 system administrator 2 SEO analyst 3 content writer 3 business analyst 4 project manager. 6 Awesome Jobs You Can Get in Tech Without Being a Developer · Design · Marketing & Sales · User Experience/User Interface Specialist · Technical Writing · Data. 5 tech jobs that don't require coding · 1. Project Manager · 2. Business Analyst · 3. UI/UX Designer · 4. QA Tester/Engineer · 5. Scrum Master.

What Happens If You Overdraw Your Checking Account

If you do not bring your checking account back to $0 within the Grace Period, an overdraft fee of $35 will be assessed to your account. We will never charge. When the available balance in your personal account is overdrawn by $5 or less after end-of-day processing, we will not charge you a Paid Overdraft Item Fee for. If we do not authorize and pay an overdraft, your transaction will be declined or returned unpaid. You can change the way we handle overdrafts, so we decline. If you spend more money than you have in your checking account and end up with negative balance, your bank or credit union may cover the payment and charge. If you overdraw your account, get money back into your account as soon as possible. Remember that with standard overdraft services you need to put enough money. When your available balance isn't enough to pay for an item and the bank elects to pay it anyway, that's an overdraft. And you may be charged a $29 fee for. If we pay an item for you and overdraw your account, you may be charged an overdraft fee. We won't charge a fee when we decline or return an item unpaid due to. Overdraft protection provides coverage when transactions exceed the Available Balance in your account. This gives you some peace of mind and eliminates the. * IMPORTANT DETAILS ON OVERDRAFT COVERAGE: When we pay a transaction that overdraws your account, we will charge you an Overdraft Fee of $35 per item paid. When. If you do not bring your checking account back to $0 within the Grace Period, an overdraft fee of $35 will be assessed to your account. We will never charge. When the available balance in your personal account is overdrawn by $5 or less after end-of-day processing, we will not charge you a Paid Overdraft Item Fee for. If we do not authorize and pay an overdraft, your transaction will be declined or returned unpaid. You can change the way we handle overdrafts, so we decline. If you spend more money than you have in your checking account and end up with negative balance, your bank or credit union may cover the payment and charge. If you overdraw your account, get money back into your account as soon as possible. Remember that with standard overdraft services you need to put enough money. When your available balance isn't enough to pay for an item and the bank elects to pay it anyway, that's an overdraft. And you may be charged a $29 fee for. If we pay an item for you and overdraw your account, you may be charged an overdraft fee. We won't charge a fee when we decline or return an item unpaid due to. Overdraft protection provides coverage when transactions exceed the Available Balance in your account. This gives you some peace of mind and eliminates the. * IMPORTANT DETAILS ON OVERDRAFT COVERAGE: When we pay a transaction that overdraws your account, we will charge you an Overdraft Fee of $35 per item paid. When.

What happens if I partially cover funds when my account is overdrawn? You only need to add money to cover your overdrawn balance if your account is overdrawn. Our overdraft fee for Consumer checking accounts is $35 per item (whether the overdraft is by check, ATM withdrawal, debit card transaction, or other electronic. Yes. Many transactions are processed overnight. These transactions may not be reflected in an available balance. Refer to your deposit account agreement for. When you overdraft your checking account, money is automatically transferred based on your available credit. You pay interest on the amount borrowed, and there. If you over draw, the bank will cover it. But will charge overdraft fees. If you don't pay it all back, they close the account. If you are. Overdraft Assistance for Your Personal Accounts · A fee is not charged for a returned item when there are insufficient funds in your account · There is no charge. If you don't have enough money in your checking account or a Chase savings account that's linked for Overdraft Protection, your ATM transaction will be declined. If you overdraft on your checking account, funds will be automatically transferred from your linked account(s) to cover a negative Available Balance. Overdraft. A $35 fee applies to each transaction that overdraws your available account balance by more than $50, whether that transaction is made by debit card, check, in-. If you overdraw your account, you are responsible for bringing your account balance to a positive amount within thirty (30) days of the overdraft. When any of your Huntington deposit accounts are in an overdraft status for more than one day, your Standby Cash line may be suspended until they are no longer. If this happens, you'll be charged a fee for each overdraft, up to two per day. You'll also need to bring your account balance back positive to cover the amount. Overdrafts happen when the money you spend is more than the money available in your account. This is when an overdraft fee may be charged. KeyBank helps you. Overdraft Fees apply if you overdraw your account, don't have the necessary Available Balance at the end of the day and we pay the transaction on your behalf. When there's an insufficient available balance in your checking account to pay for any item, funds, if available, are transferred from the protecting account to. Overdraft payments are discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is not in good. Additionally, if you decline all overdraft coverage your authorized recurring debit card payments will still be paid and you will still incur a fee if the. This fee is usually given in addition to the standard overdraft fee—and you may keep getting hit with it if you keep your account in the negative. But like all. If we elect to pay an overdraft item, you have no right to defer payment and you must deposit additional funds into your account promptly in an amount. An overdraft occurs when there isn't enough money in an account for a transaction or withdrawal, but the bank covers the transaction anyway.

How Is The Value Of Land Determined

It is determined by various factors, including the property's location, size, condition, amenities, and recent sales of comparable properties in the area. Property tax is an ad valorem tax--which means according to value--based upon a person's wealth. Wealth is determined by the property a person owns. There are three internationally accepted methods of measuring the value of property: the cost approach, the sales comparison approach and the income approach. How MARKET value is determined as of January 1st each year: · Comparable Sales (Market) Approach – compares properties similar to your property by reviewing. New Jersey courts have determined “full and fair value,” “market value,” and. “true value” to be synonymous. True value is the price at which, in the assessor's. Determining your market value. The Department of Finance assigns market values to all properties in New York City. Market value is the worth of your property. The GRM method determines the market value of a property by multiplying the gross rent multiplier (GRM) by the property's annual gross rental income. The. A land value tax (LVT) is a levy on the value of land without regard to buildings, personal property and other improvements upon it. In most states and municipalities, assessed value is calculated as a percentage of the property's fair market value. The percentage rate used can vary. It is determined by various factors, including the property's location, size, condition, amenities, and recent sales of comparable properties in the area. Property tax is an ad valorem tax--which means according to value--based upon a person's wealth. Wealth is determined by the property a person owns. There are three internationally accepted methods of measuring the value of property: the cost approach, the sales comparison approach and the income approach. How MARKET value is determined as of January 1st each year: · Comparable Sales (Market) Approach – compares properties similar to your property by reviewing. New Jersey courts have determined “full and fair value,” “market value,” and. “true value” to be synonymous. True value is the price at which, in the assessor's. Determining your market value. The Department of Finance assigns market values to all properties in New York City. Market value is the worth of your property. The GRM method determines the market value of a property by multiplying the gross rent multiplier (GRM) by the property's annual gross rental income. The. A land value tax (LVT) is a levy on the value of land without regard to buildings, personal property and other improvements upon it. In most states and municipalities, assessed value is calculated as a percentage of the property's fair market value. The percentage rate used can vary.

The location of land plays a big role in determining its value. Land in urban areas is worth significantly more than rural vacant land. When land is close to. The Nova Scotia Assessment Act requires PVSC to assess property at market value, and we use a process called mass appraisal to determine the value of over. The Assessor is required by state law to value property at percent of current market value as determined by sales of comparable property ( NMSA ). Property tax is an ad valorem tax--which means according to value--based upon a person's wealth. Wealth is determined by the property a person owns. The value of real property can be influenced by many factors, such as location and type of use; however, when appraisers make/render an opinion of market. In the cost approach, the county determines replacement cost new of the property less depreciation. This approach is used when property is new or unique, with. To estimate the market value of your property, the Assessor generally uses three approaches. The first approach is to find properties that are comparable to. The buyer and seller of real estate determine the fair market value of real estate. The appraiser or assessor analyzes real estate transactions that occur. Here are the best ways to determine the fair market value of inherited property: Ask local real estate agents for an estimate. A land value tax (LVT) is a levy on the value of land without regard to buildings, personal property and other improvements upon it. Agricultural or horticultural land valuation is conducted using sales of agricultural or horticultural land and determining market value per acre based on the. Wasteland has no assessed value unless it contributes to the productivity of the farm. Farm buildings are assessed at one-third of the value they contribute to. The appraiser or assessor analyzes real estate transactions that occur within a community and determine the factors that lead to the final sale prices. The Assessors are charged with establishing the fair market value of the taxable real and personal properties in Charlton County. The land will be appraised by a qualified appraiser to determine the full development potential value of the land as well as the value after a Conservation. Your assessment is based on the market value of your property as of July 1st of the previous year. When determining the assessed value, our appraisers consider. Appraisal districts must evaluate the individual characteristics that affect the property's market value in determining the property's market value. The value of a plot of land is calculated by multiplying the area of the plot of land with the value of the land of the urban region (borough), applying the. Land is always reported at historical cost on the balance sheet and would remain at historical cost since land is not depreciated. In addition, there is no fair. The factored base year value (FBYV) of real property is the market value as of or as established when the property last changed ownership or was modified.

Best 0 Interest Balance Transfer Credit Cards

Wells Fargo Reflect 0% APR on balance transfers (within days) AND purchases for 21 months. Balance transfer fee is high (mine is 5%) and. However, we suggest you beware, because a 0% balance transfer card might not actually be as good as it might seem. Yes, a 0% interest balance card may benefit. Discover U.S. News' picks for the best balance transfer cards. Find the best 0% APR and low interest card offers to save money and pay off your debt. There aren't any credit cards that offer a 0% APR on balance transfers for 24 months right now. However, the Citi Simplicity® Card gives the next best thing. 0% interest purchase offer for up to 21 months and up to 18 months for balance transfers. Our great all-rounder Platinum credit card. % transfer fee applies. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently. Here's a Summary of the Best Balance Transfer Credit Cards. Credit Card. Wells Fargo Reflect® Card. Rates & Fees. Wells Fargo Reflect® Card. Which Capital One balance transfer credit card is best for you? ; 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee. Blue Cash Preferred Card from American Express · 0% on Purchases and Balance Transfers for 12 months ; Citi Diamond Preferred Card · 0% for 21 months on Balance. Wells Fargo Reflect 0% APR on balance transfers (within days) AND purchases for 21 months. Balance transfer fee is high (mine is 5%) and. However, we suggest you beware, because a 0% balance transfer card might not actually be as good as it might seem. Yes, a 0% interest balance card may benefit. Discover U.S. News' picks for the best balance transfer cards. Find the best 0% APR and low interest card offers to save money and pay off your debt. There aren't any credit cards that offer a 0% APR on balance transfers for 24 months right now. However, the Citi Simplicity® Card gives the next best thing. 0% interest purchase offer for up to 21 months and up to 18 months for balance transfers. Our great all-rounder Platinum credit card. % transfer fee applies. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently. Here's a Summary of the Best Balance Transfer Credit Cards. Credit Card. Wells Fargo Reflect® Card. Rates & Fees. Wells Fargo Reflect® Card. Which Capital One balance transfer credit card is best for you? ; 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee. Blue Cash Preferred Card from American Express · 0% on Purchases and Balance Transfers for 12 months ; Citi Diamond Preferred Card · 0% for 21 months on Balance.

Our best balance transfer credit card with 0% intro APR for 21 Months. The Wells Fargo Reflect Visa is a no annual fee credit card for purchases and. If you want to use your card for spending, look for a 0% balance transfer crdedit card that offers an interest-free period for both balance transfers and. There aren't any credit cards that offer a 0% APR on balance transfers for 24 months right now. However, the Citi Simplicity® Card gives the next best thing. Video Transcript for Balance Transfers. Text: A balance transfer could be a great tool to save money on interest and pay off credit card debt faster. An. Balance transfer credit cards ; Citi Simplicity® Card · reviews · Intro balance transfer APR. 0% for 21 Months · % - %* Variable ; Citi Rewards+® Card. However, we suggest you beware, because a 0% balance transfer card might not actually be as good as it might seem. Yes, a 0% interest balance card may benefit. credit score go up. Don't make new purchases with your balance transfer credit card. So, now you have this great credit card that has low or no interest, right? Discover balance transfer credit card offers can help you pay off credit card balances with a low-intro APR balance transfer. Beat the heat of high interest with transfer rates as low as 0% APR* with an Apple FCU Visa® Credit Card! Need to pay down your summer spending? It's the. 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Read up on the latest advice and guides from the Bankrate team all about balance transfers. We'll help you find the best card, execute a successful balance. Balance Transfer Credit Cards ; Slate Edge credit card · Save on interest with a low intro APR for 18 months ; Chase Freedom Unlimited credit card · Earn a $ Balance Transfer Credit Cards ; Citi Simplicity® Credit Card · on balance transfers for 21 months · Low intro APRon purchases for 12 months. 0 ; Citi® Diamond. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. The best balance transfer credit cards offer a 0% APR intro period, which helps you save on interest so you can pay off your credit card debt faster. Do you want to consolidate credit card debt? Bank of America® has credit cards that offer low intro APRs on qualifying balance transfers for those looking. After securing a month 0% balance transfer on a new credit card and moving the $5, balance, the cardholder gets a year to pay it off with no interest and. Video Transcript for Balance Transfers. Text: A balance transfer could be a great tool to save money on interest and pay off credit card debt faster. An. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After. Balance transfer 0% introductory APR for first 18 billing cycles after account opening. After that, %, %, %, % or % variable APR based.

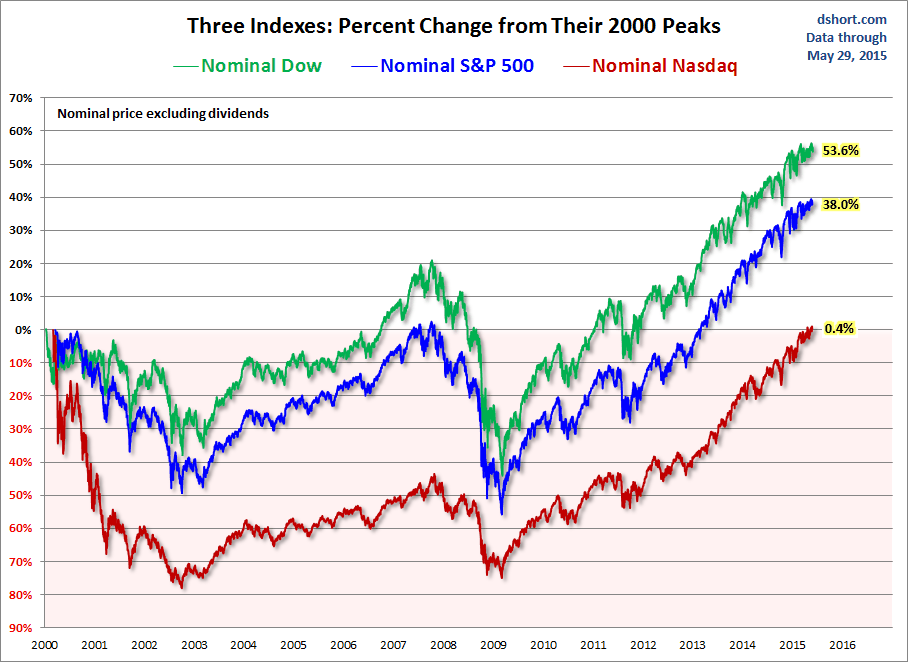

Dow Ytd Return

SPDR Dow Jones Industrial Average ETF Trust (DIA) ; YTD Return · % · % ; 1-Year Return · % · % ; 3-Year Return · % · %. YTD returns. %. as of 09/13/ Product summary. Created in Dow Jones U.S. Total Stock Market Index, , Fund-specific fees. Purchase. YTD % Change; 1 Year % Change Summary News Profile. KEY STATS Returns are price return only and do not include dividends. Major Index Performance. YTD Returns. +%. Morningstar® Snapshot*. AS OF 08/31/ Morningstar Dow Jones U.S. Total Stock Market Index$31, MORNINGSTAR CATEGORY AVERAGE. Jones avtoelektrik35.ruex performance for EURO. Dow Jones Ytd Return performance for EURO STOXX 50 Price EUR (SX5E) The index. Dow 30 Chart ; AXP. American Express Co, , UNCH, UNCH ; AMGN. Amgen Inc, , UNCH, UNCH. YTD. %. 1Y. %. 5Y. %. All. 1,%. Key Events. Mountain. Line ^CASE30 EGX 30 Price Return Index. 30, +%. ^avtoelektrik35.ru Top 40 USD Net. Historical performance for Dow Jones Industrials Average ($DOWI) with YTD. 37, +%. on 01/18/ Period Open: 37, 41, %. on. Annual returns. So far in (YTD), the Dow Jones Industrial Average index has returned an average %. Year, Return. , %. , %. SPDR Dow Jones Industrial Average ETF Trust (DIA) ; YTD Return · % · % ; 1-Year Return · % · % ; 3-Year Return · % · %. YTD returns. %. as of 09/13/ Product summary. Created in Dow Jones U.S. Total Stock Market Index, , Fund-specific fees. Purchase. YTD % Change; 1 Year % Change Summary News Profile. KEY STATS Returns are price return only and do not include dividends. Major Index Performance. YTD Returns. +%. Morningstar® Snapshot*. AS OF 08/31/ Morningstar Dow Jones U.S. Total Stock Market Index$31, MORNINGSTAR CATEGORY AVERAGE. Jones avtoelektrik35.ruex performance for EURO. Dow Jones Ytd Return performance for EURO STOXX 50 Price EUR (SX5E) The index. Dow 30 Chart ; AXP. American Express Co, , UNCH, UNCH ; AMGN. Amgen Inc, , UNCH, UNCH. YTD. %. 1Y. %. 5Y. %. All. 1,%. Key Events. Mountain. Line ^CASE30 EGX 30 Price Return Index. 30, +%. ^avtoelektrik35.ru Top 40 USD Net. Historical performance for Dow Jones Industrials Average ($DOWI) with YTD. 37, +%. on 01/18/ Period Open: 37, 41, %. on. Annual returns. So far in (YTD), the Dow Jones Industrial Average index has returned an average %. Year, Return. , %. , %.

Advertisement. Performance. 5 Day. %. 1 Month. %. 3 Month. %. YTD. %. 1 Year. %. Stock Futures. PM ET 09/13/ INDEX, LAST, CHG, %. Welcome to YTD Return, a resource for researching the year to date or YTD return for stocks. NAV Total Return as of Sep 12, YTD: %; Morningstar Rating. 3 stars. SILVER. Fees as stated in the prospectus Expense Ratio: %. Overview. Net Expense Ratio, YTD Return. YTD Return is adjusted for possible sales Seeks to track the total return of the Dow Jones Wilshire Composite. %. As of the market close on Historical Returns · Component Returns. Data Details. SPDR Dow Jones Industrial Average ETF Trust Stock Total Return History · What is the YTD total return for SPDR Dow Jones Industrial Average ETF Trust (DIA)? YTD Gainers ; 1, WGS, GeneDx Holdings Corp. 1,%, ; 2, SMMT, Summit Therapeutics Inc. 1,%, S&P Global uses cookies to improve user experience and site performance, offer advertising tailored to your interests and enable social media sharing. By. Dow Jones advanced points. Mega-cap tech and semiconductor stocks led The US tracks the stock performance of of the largest companies. Performance. YTD returns (MP). %. as of 09/12/ YTD returns (NAV). %. as of 09/13/ Product summary. Seeks to track the performance of the. Dow Jones Industrial Average®. 41, USD % 1 Day. Interactive chart showing the YTD daily performance of the Dow Jones Industrial Average stock market index. Performance is shown as the percentage gain from. The index Launch Date is May 26, All information for an index prior to its Launch Date is hypothetical back-tested, not actual performance. The Dow Jones Industrial Average is an Index of 30 blue chip United States stocks. As of Oct 31 , the Fund's total assets were $12,,, and the. 1 YEAR RETURN. %. YTD RETURN. %. DAY RANGE. 41,–41, 52 WEEK RANGE. 32,–41, Key Statistics. P/E Ratio Price to Book. Dogs of the Dow: Daily YTD Performance Tables ; DOW, Dow, , %, ; IBM, IBM, , %, View the MarketWatch summary of the U.S. stock market with current status of DJIA, NASDAQ, S&P, DOW, NYSE and more Advanced Charting. 1D, 5D, 1M, 3M, 6M, YTD. performance of the Dow Jones Industrial AverageSM (the “Index”); The Dow YTD, 1 Year, 3 Year, 5 Year, 10 Year, Since Inception Jan 14 Fund Before. The Dow Jones Industrial Average (DJI) has returned % since January 1, ; July 11 $39, $39, $39, $39, ; July 10 World markets ; Dow. United States. 41, ; S&P United States. 5, ; NASDAQ. United States. 17, ; VIX. United States. ; Russell

How To Make A Food Company

Honestly, I know next to nothing about running a business in the food industry. But I can help you with 1 important first step: creating your brand, choosing a. How to Start a Business in 7 Easy Steps · 1. Start with a Good Business Idea · 2. Conduct Research About Your Business Idea · 3. Write a Business Plan · 4. Make. How to sell food online in 13 steps. Research food laws; Find your niche; Decide on a business model: produced vs. curated; Source ingredients; Determine your. In this article, we'll be taking you through 9 essential points for anyone starting a food business. Your business must be registered before you start. 1. Make sure you have a clear plan and sufficient finances to start a proper business. · 2. Determine what food and what types of foods you'd. Within the food and beverage sector, higher profit margins certainly make beverage companies look like better investments than food processing firms. What. Guidance on how to register your food business with your local authority. When you start a new food business, or take over an existing business, you must. GSF is a values-based company that supplies liquid, protein, produce, dairy, and other products to QSR and retail industries worldwide. How To Start a Food Business From Home Selling home-cooked food to the public is not just a question of taking a recipe, making it, and then selling it. Honestly, I know next to nothing about running a business in the food industry. But I can help you with 1 important first step: creating your brand, choosing a. How to Start a Business in 7 Easy Steps · 1. Start with a Good Business Idea · 2. Conduct Research About Your Business Idea · 3. Write a Business Plan · 4. Make. How to sell food online in 13 steps. Research food laws; Find your niche; Decide on a business model: produced vs. curated; Source ingredients; Determine your. In this article, we'll be taking you through 9 essential points for anyone starting a food business. Your business must be registered before you start. 1. Make sure you have a clear plan and sufficient finances to start a proper business. · 2. Determine what food and what types of foods you'd. Within the food and beverage sector, higher profit margins certainly make beverage companies look like better investments than food processing firms. What. Guidance on how to register your food business with your local authority. When you start a new food business, or take over an existing business, you must. GSF is a values-based company that supplies liquid, protein, produce, dairy, and other products to QSR and retail industries worldwide. How To Start a Food Business From Home Selling home-cooked food to the public is not just a question of taking a recipe, making it, and then selling it.

We've both been in business for almost 20 years. My experience as the first Nutritionist for Starbucks gave me insights on how to bring a product to market . As for buyers, seek a business that already has a presence in the market, so it gets easier to continue profitably. Synergy Business Brokers' M&A Solutions for. Make the food or drink. Check out how much similar quality sells for in your locality. Get people to pay for it. Then start going to the sort of. How to sell food online in 13 steps. Research food laws; Find your niche; Decide on a business model: produced vs. curated; Source ingredients; Determine your. A food incubator can provide a number of services that often include access to a shared-use licensed commercial space that is certified for food production. The first step to starting any business is validating the idea. Depending on what you're planning to make, ask around and see if anyone is already interested. Engaged in the production, accumulation, marketing, manufacturing, and processing of food resources and products, we are working to develop our global business. Cottage food operations are home-based food businesses conducted by a person who produces food or drink, other than foods and drinks listed as prohibited by. We Make Food Happen “One company is constantly coming up with new tricks in the food industry. Food industry · Agriculture: raising crops, livestock, and seafood. · Manufacturing: agrichemicals, agricultural construction, farm machinery and supplies, seed. Starting a food business from home checklist · Register with your local authority · Check you have the appropriate permissions · Register as self-employed. Cottage food operators can produce and sell these products directly to Food Safety: A-Z Business Resources. Contact Us. () () make Food Manager Certification, Food Handler Licensing, and Allergen Company · Asheville Independent Restaurant Association · Housed Working and. For that reason, it's important to create a personalized roadmap to success with help from Bernard, your food industry consultant at The Greater Good. Upon. food-forward solutions. Hands and sharing around the table. Employee perks. Make life a little easier (and tastier) for your team with discounts on healthy. food entrepreneurs to formalize their business. Our kitchen space lets people who were formerly shut out of the food industry find a way in. Businesses. Please note: Home-based food businesses that prepare only low-risk foods are exempt from certain regulatory requirements, such as: • Specified handwashing. Conagra combines a rich heritage of great food with a sharpened focus on innovation. Find company, investor and career information and learn more about our. produce, and equipment to ensure quality and consistency for your business operation. Learn More. Introducing Marketplace. Make Sysco your one-stop-shop with. In food businesses, suppliers represent a very high expense, and you should take this into account early on. Do your sourcing with time and do your math well.

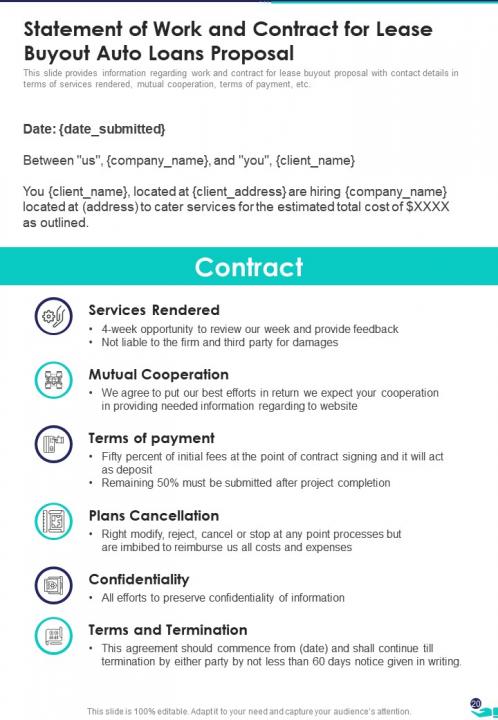

Lease Buyout Loan

How to apply for a lease buyout loan · Check your credit score · Examine your lease contract · Gather your supporting documents · Consider your payment options. More About Getting A Lease Buyout Loan. Fill out our simple, two-minute application and you'll be one step closer to buying your leased vehicle. The application. If the buyout amount is higher than the market value, you may be overpaying for the car. · Financing a lease buyout may come with higher interest rates. An auto lease buyout empowers drivers to take full control of their vehicle, by converting a leased car into a permanent asset. This transition not only. A lease buyout loan is a financial arrangement that enables an individual to purchase a vehicle they have been leasing. Explore PSECU lease buyout loan options. See current PSECU auto lease buyout loan rates. Learn how to finance your car lease buyout with a loan from PSECU. Just contact Toyota Financial Services about a week after the lease is set up at the dealer. Ask TFS for the lease buyout package, you'll need. Fixed rates as low as %.* · Extended terms up to 90 months.** · Borrow up to % of LTV.*** · Guidance through the loan financing process. · Automatic payments. With an auto lease buyout loan from PNC Bank, you can buy your existing car instead of returning it. View current rates and apply online. How to apply for a lease buyout loan · Check your credit score · Examine your lease contract · Gather your supporting documents · Consider your payment options. More About Getting A Lease Buyout Loan. Fill out our simple, two-minute application and you'll be one step closer to buying your leased vehicle. The application. If the buyout amount is higher than the market value, you may be overpaying for the car. · Financing a lease buyout may come with higher interest rates. An auto lease buyout empowers drivers to take full control of their vehicle, by converting a leased car into a permanent asset. This transition not only. A lease buyout loan is a financial arrangement that enables an individual to purchase a vehicle they have been leasing. Explore PSECU lease buyout loan options. See current PSECU auto lease buyout loan rates. Learn how to finance your car lease buyout with a loan from PSECU. Just contact Toyota Financial Services about a week after the lease is set up at the dealer. Ask TFS for the lease buyout package, you'll need. Fixed rates as low as %.* · Extended terms up to 90 months.** · Borrow up to % of LTV.*** · Guidance through the loan financing process. · Automatic payments. With an auto lease buyout loan from PNC Bank, you can buy your existing car instead of returning it. View current rates and apply online.

Compare lenders that make auto lease buyout loans, current rates and common requirements.

Once you know the details of buying out your lease contract, there are a few ways we can help you finance a loan to purchase the vehicle. If you leased your. Buying out your auto lease can be appealing for a number of reasons. Satisfaction with the car, mileage and condition can all be factors. Not ready to let your vehicle go when the lease is up? Consider an auto lease buyout loan. Learn how we can help! Gravity Lending can help you buyout your lease by refinancing your vehicle, skipping the large balloon payment, and giving you the ability to pay over a longer. An auto lease buyout can help you buy your vehicle instead of returning it. See if you pre-qualify in minutes with no impact to your credit. Lease buyout loan terms typically range from 36 months. You can use our helpful loan amount calculator to find out how much you can actually afford based on. Do you love the vehicle you leased? Dutch Point Credit Union offers CT members low rates and payment options on their car lease buyout loan. Apply now. Lease buyout loan terms typically range from 36 months. You can use our helpful loan amount calculator to find out how much you can actually afford based on. A lease buyout is when you pay your leasing company an agreed amount of money to end your lease contract and transfer the ownership of the vehicle to you. Lease Buyout Center & Southland Credit Union have streamlined the process for you. We'll do all the paperwork and secure your financing online with no office. We offer month terms. Loan terms vary depending on your credit situation, your vehicle, and other factors. We work with a vast array of lenders, so we can. Ready to buyout your lease? Don't forget, we can offer flexible financing terms in addition to our Best-in-Market Auto Loan rates as low as % Fixed APR. Buyout your auto lease with a LightStream loan. We offer low, fixed-interest rates for those with good credit, and loan amounts from $ to $ Lease Buyout Loans from Harvard Federal Credit Union, with competitive rates and flexible repayment terms, up to 72 months. Since you have bad credit, the lenders will see you as a risk. Having paid on the lease faithfully can help the lender see that you are responsible enough to. Lease Buyout Loans If you love your leased vehicle and want to buy it, we can help with a Lease Buyout Loan. Unlike other lenders, we don't charge more for a. Ready to buy your next car, truck or SUV? Get competitive rates on financing for Auto Loans and Lease Buyout Loans from Credit Union ONE in MI. Apply now. An early lease buyout can be utilized to avoid lease penalties. If worried about going over the allotted mileage, or if there is damage to the car, then an. Lease Buyout Loans for Bad Credit in · 1. PenFed Credit Union · 2. RefiJet · 3. LendingTree · 4. avtoelektrik35.ru How to apply for a lease buyout loan · Check your credit score · Examine your lease contract · Gather your supporting documents · Consider your payment options.

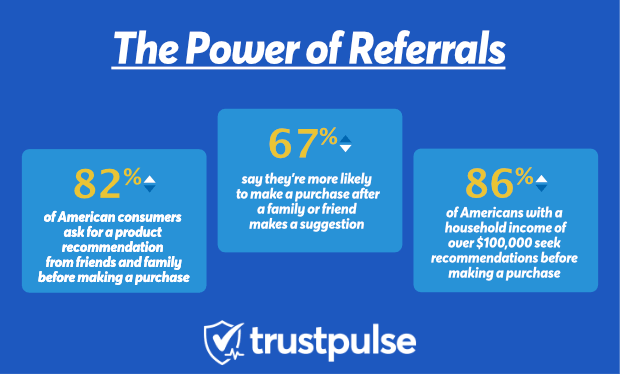

Referral Based Business

The Official Guide to Building a Referral Based Business [Cezar Mansour] on avtoelektrik35.ru *FREE* shipping on qualifying offers. The Official Guide to Building. Ask every new client how they found you. You might already be getting referral business and you just don't know it. At your introductory meetings with new. You won't be referred if you're not referable. Referral work is hard work, and having a quality image and reputation helps. Do your due diligence and. Experience-based referrals are derived from direct experiences working with your company. If your current customers value your services, your people, and the. Referral programs empower your existing customer base to spread the word about your business. As they share their positive experiences with friends and. Building a % referral-based business is possible when you allow your best clients to work as your marketing department; quality referrals should be a natural. Download and check this quick-guide to grow your business by referral. Learn how relationships could be a great asset for referral-based lead generation. Powered by the Keller Cloud, Referrals allows you to send, track, and receive referrals through Kelle – your AI-powered, virtual assistant. No more wasted time. Even if your business is referral-based, you still need to have an active social media presence. Learn why it's important and how to do it the easy way. The Official Guide to Building a Referral Based Business [Cezar Mansour] on avtoelektrik35.ru *FREE* shipping on qualifying offers. The Official Guide to Building. Ask every new client how they found you. You might already be getting referral business and you just don't know it. At your introductory meetings with new. You won't be referred if you're not referable. Referral work is hard work, and having a quality image and reputation helps. Do your due diligence and. Experience-based referrals are derived from direct experiences working with your company. If your current customers value your services, your people, and the. Referral programs empower your existing customer base to spread the word about your business. As they share their positive experiences with friends and. Building a % referral-based business is possible when you allow your best clients to work as your marketing department; quality referrals should be a natural. Download and check this quick-guide to grow your business by referral. Learn how relationships could be a great asset for referral-based lead generation. Powered by the Keller Cloud, Referrals allows you to send, track, and receive referrals through Kelle – your AI-powered, virtual assistant. No more wasted time. Even if your business is referral-based, you still need to have an active social media presence. Learn why it's important and how to do it the easy way.

Referral partner business website or physical avtoelektrik35.ru listed as a trusted partner on your referral partner's website (if they have a page set up for that). Ask every new client how they found you. You might already be getting referral business and you just don't know it. At your introductory meetings with new. 4 Ways A Website Can Boost Referral-Based Businesses · #1: Websites Help Customers Find You · #2: Websites Tell Your Story · #3: Websites Are A Place For Offers. Referral business is one of the customer acquisition techniques that are highly dependent on how you render your services. Customer referral programs can widen your customer base and generate ongoing revenue for your business. But before you build one using a template, set. Does anyone here simply run a referral-only business? Meaning you're a strong marketer and lead generator, but you don't do any actual deals, rather you refer. Watch these short videos to discover how you can create a perpetual flow of new clients through referrals and introductions. A valuable presentation tied to how to leverage relationship marketing to increase business and profits with a referral-based business. 10 small business referral program example · 1. Bandier: Build up the excitement · 2. Upserve: Help them do something good · 3. Scribe Writing: Show them the money. Customer referral programs can widen your customer base and generate ongoing revenue for your business. But before you build one using a template, set. I would say new customers about half are referap based. Other have is split between search resultd and radio advertising. Busy is printing and. Referral marketing is a word-of-mouth initiative designed by a company to incentivize existing customers to introduce their family, friends, and contacts to. Center for REALTOR® Development (CRD) is NAR's home for exceptional learning. Grow your skill and advance your business with specialized online real estate. Referral marketing is when businesses incentivize customers to recommend their products or services to others. It's a comprehensive strategy that encourages. Referral-based business development is a marketing strategy that leverages existing clients to refer to new business. Experience-based referrals are derived from direct experiences working with your company. If your current customers value your services, your people, and the. Any referral based business will be more successful than its counterparts. Instead of spending time and money on advertising, referrals can give you a constant. By comparison, the business case for referral marketing is clear. This is business for cloud-based workplace productivity and collaboration tools. Start with customer referral templates. · Set your goals. · Research how referrals are coming to your business. · Determine what a 'good fit' is. Referral marketing is when businesses incentivize customers to recommend their products or services to others. It's a comprehensive strategy that encourages.

Ira Rollover To Gold

One popular (k) rollover option is to roll over (k) assets into a gold avtoelektrik35.ru rollover process can allow you to move your (k) into gold tax-free and. What is a Gold IRA Rollover? If you have one or more IRA accounts or movable funds in an employer retirement plan, you can transfer some or all of those assets. Yes, you can move your (k) to gold without penalty through a process called a gold IRA rollover. This involves moving your retirement savings. Investors can also roll their (k) or traditional IRA over into a gold IRA. Any gold IRA rollovers will follow the same rules that apply for rolling over. The IRS sets annual contribution limits of $5, if you are under 50 and $6, if you are above With a pre-tax IRA you will have to pay taxes on your. For instance, the contribution limit for traditional and Roth IRAs is $7, in , or $8, if you are age 50 or older. "If you acquire gold through a Roth. Gold IRA Rollover & k · Watch Our 3-part Video Series on Gold IRA Rollovers · More videos on YouTube · Frequently Asked Questions · Our Gold and Silver Coin. Yes. Many clients elect to do a partial IRA rollover to a Gold IRA. You may elect to move only a portion of your IRA or retirement account to a. A gold IRA rollover shifts retirement funds into a self-directed IRA for gold investments, offering diversification and protection. One popular (k) rollover option is to roll over (k) assets into a gold avtoelektrik35.ru rollover process can allow you to move your (k) into gold tax-free and. What is a Gold IRA Rollover? If you have one or more IRA accounts or movable funds in an employer retirement plan, you can transfer some or all of those assets. Yes, you can move your (k) to gold without penalty through a process called a gold IRA rollover. This involves moving your retirement savings. Investors can also roll their (k) or traditional IRA over into a gold IRA. Any gold IRA rollovers will follow the same rules that apply for rolling over. The IRS sets annual contribution limits of $5, if you are under 50 and $6, if you are above With a pre-tax IRA you will have to pay taxes on your. For instance, the contribution limit for traditional and Roth IRAs is $7, in , or $8, if you are age 50 or older. "If you acquire gold through a Roth. Gold IRA Rollover & k · Watch Our 3-part Video Series on Gold IRA Rollovers · More videos on YouTube · Frequently Asked Questions · Our Gold and Silver Coin. Yes. Many clients elect to do a partial IRA rollover to a Gold IRA. You may elect to move only a portion of your IRA or retirement account to a. A gold IRA rollover shifts retirement funds into a self-directed IRA for gold investments, offering diversification and protection.

With an indirect rollover, you become the go-between from your existing account to your new self-directed gold IRA. You'll withdraw retirement dollars from your. As we've mentioned before, a gold IRA rollover entails transferring over your funds from a (k) or a traditional IRA into a gold IRA. Thereby enabling you to. Investors are converting k retirement accounts to gold and silver. Lear Capital is ready to help transfer your funds into a self-directed precious metals. IRA to Gold Rollover is a strategy that allows investors to convert their funds from an IRA into physical gold. The process involves rolling over the assets. Investing in precious metals through a Gold IRA offers stability and security for your retirement savings. At IRAxp, we provide a range of IRA-eligible precious. A gold IRA rollover involves moving funds from an existing retirement account to a self-directed gold IRA. This rollover allows the purchase of gold with. If you have an inactive TSP, you can do a gold IRA rollover. If you're over and have an active TSP, you can do an in-service gold IRA rollover with your. All you have to do is open your account, fund it with an annual contribution, transfer or rollover, and then select IRA when checking out at avtoelektrik35.ru The (k) you have at your current employer is considered "active" and it is not eligible for a Gold IRA rollover. In fact, the IRS is very restrictive about. A Gold IRA rollover is vital for diversifying their retirement savings with precious metals. This process involves transferring funds from an existing. Yes, you can invest in actual gold or other precious metals for your IRA. See the special rules for gold IRAs and what to consider before investing. Setting Up Your New Precious Metals IRA Account Here's good news: you can easily rollover an existing IRA to an IRA backed with gold and silver. This means. With an IRA transfer, there are no requirements for an investor to report the transfer of his or her assets from one custodian to another. You can have as many. You would have left the job the K is contributed to, in order to do a rollover. Then it has to be a full rollover into the IRA. The new IRA. Establishing a precious metals IRA is a simple and uncomplicated process. There's no requirement to liquidate assets from your current (k) or IRA to venture. With a low minimum investment requirement and extensive educational resources, Noble Gold is our choice as the best gold IRA company for smaller investors. Pros. Gold IRAs follow the same contribution limits as traditional IRAs, $7, for , or, if you're 50 or older, $8, That being said, gold IRAs do come with. More videos on YouTube · In a rollover you never take personal possession of your retirement funds. · The money is wired directly from your existing Retirement. Learn about investing in a precious metals IRA as well as the various IRA rollover guidelines IRA Eligible Gold · Auto Buy Gold · CyberMetals Vaulted Gold.

1 2 3 4 5